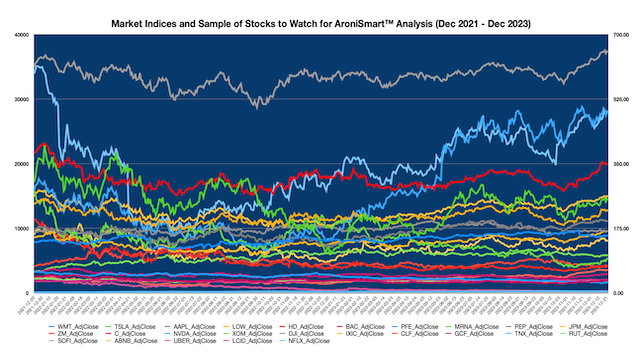

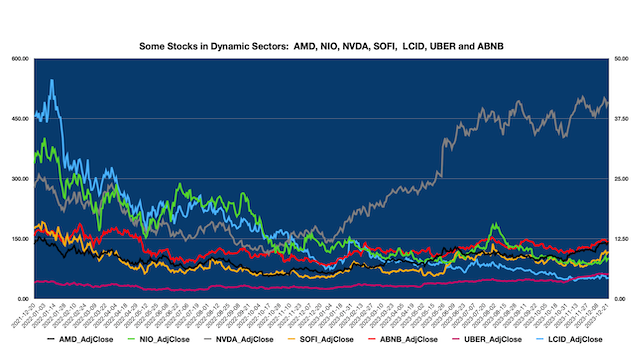

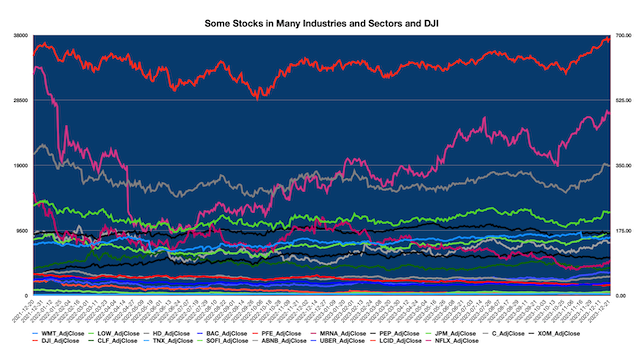

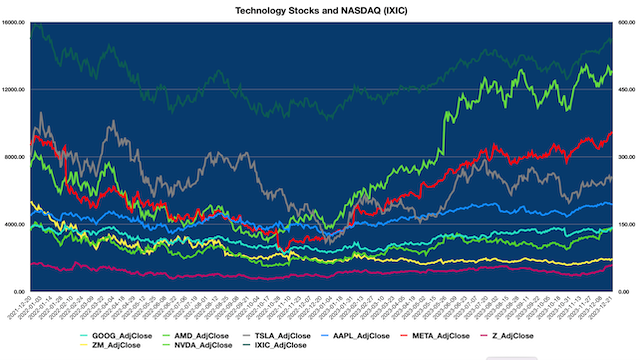

Stocks across all sectors, especially in Tech, Healthcare, Financial Services, Energy, and Consumer have been delivering differential returns over the last years including in 2021, 2022, and Q1- early Q4 2024. Most stocks reached heights in December 2021. Then, in 2022 and up to mid-Q1 2023, the stock growth became broadly negative across most sectors, except energy. The major stock market indices were also impacted. Since then, many stocks across all sectors, along with the key market indices have been on the rise, on a path to reaching the 2021 levels. In a sample of key stocks to watch, as identified by AroniSmart™ team, leveraging the Machine Learning, Econometrics, and NLP capabilities AroniSmartIntelligence™ and AroniSmartInvest™, most stocks have shown resilience and sometimes outperforming most of the other stocks and the key stock market indices. As the end of Q4 2023 is reached , almost all the stocks, along with the key indices have reached highs, even aiming at their record highs.

AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock prices of 21 selected companies between Q4 2021 and Q4 2023 and came up with insights and projections on the dynamics. This is the Part 2 of the analysis. The findings captured in Part 1 may be seen here: AroniSmartIntelligence™ in Action: Stock Performance Analysis with Sentiment Analysis, Support Vector Machine and Dominance Analysis in Q4 2023 - Part 1.

Part 2 insights are presented below (for disclaimer and terms, check AroniSoft website).

A little bit of the usual investment research before coming back to AroniSmart™'s findings.

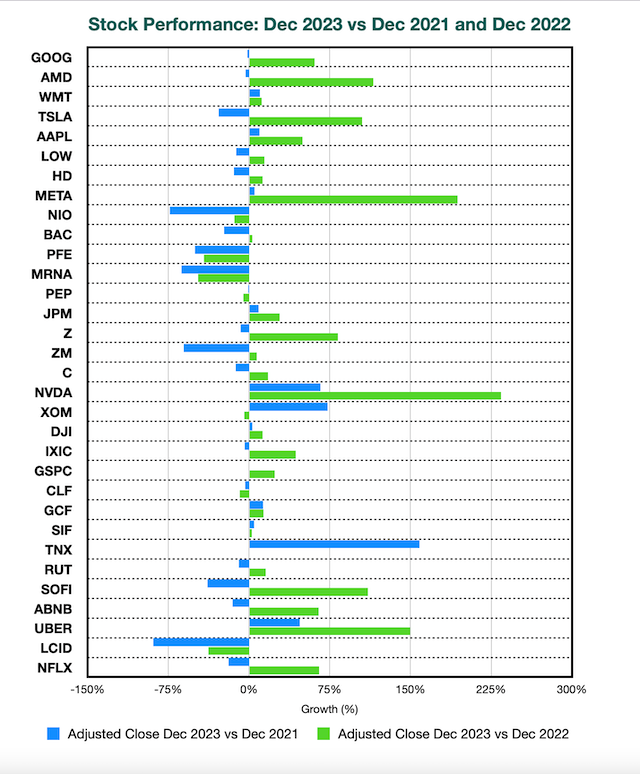

In Part 1, it was shown that most of the stocks experienced a positive growth for 2023 vs Dec 2021. Only a very few stocks like NVDA, XOM, UBER had showed a momentum. However, compared to Dec 2022, most stocks have gained a positive momentum, especially the technology stocks such as AAPL, GOOG, TSLA, META, NVDA, AMD, SOFI, NFLX and others such as UBER, and ABNB. Several stocks, especially in Healthcare and Banking have been on a downward trend. The sample included PFE, MRNA, and BAC (see here).

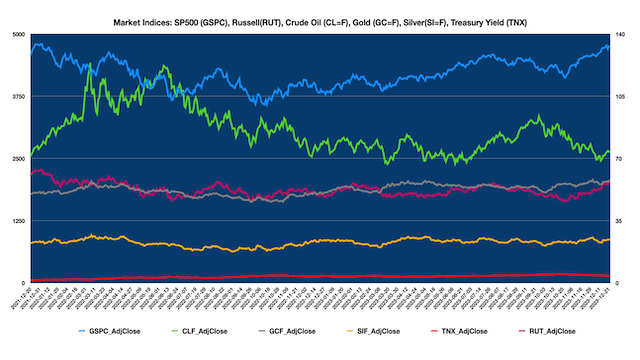

The stock market lost momentum since December 2021 while the oil industry has gained following the increasing market volatility, inflation, interest rates, world events, and other dynamics.

In this Part 2, the trends have changed. Compared to Dec 2022, most stocks have maintained a positive momentum, especially the technology stocks such as AAPL, GOOG, TSLA, META, NVDA, AMD, SOFI, NFLX and others such as UBER, and ABNB. Healthcare and Banking, including PFE, MRNA,JPM, C, and BAC have also started to regain an upward trend. Although mostly below the Dec 2021 levels, positive improvements are observed.

The indices have experienced improving trend with the following performances, as Dec 22, 2023 vs Dec 2021 and Dec 2022:

- NASDAQ Composite (^IXIC): -4% and 43%

- Dow Jones Industrial Average (^DJI): -3% and 13%

- S&P 500 (^GSPC): -0% and 24%

- Crude Oil index (CL=F): -1% and - 6%

- Russell 2000 (^RUT): -9.0% and 15%

- Gold Dec 23 (GC=F): 13% and 13%

- Silver Dec 23 (SI=F): 5% and 3%

- CBOE Interest Rate 10 Year T No (^TNX): 158% and 1%

Figure 1: Stocks and Indices Performance for December 2023 vs Dec 2021 and Dec 2022

In November 2023, most of the key market indices were still significantly below the December 2021 levels. By the end of December 2023, the picture looks different, with most indices having continually been regaining the losses experienced since 2022. DJI, NASDAQ, the Technology heavy market index, and SP500 appear to continually regain a positive momentum. However, the oil industry appears to have lost its earlier long term momentum.

Following the slowdown in the growth over 2023, Interest rates appear to have become stagnant. Gold (GC=F) and Sliver (SI=F) indices remain in positive territories for the two periods.

Advertisement

GET ARONISMARTINVEST, A LEADING INVESTMENT RESEARCH TOOL, BASED ON Advanced Analytics, machine Learning and Data Science on App Store -- click here

AroniSmart™ team has continued the analysis of the performance dynamics using a selected sample of stocks to watch. AroniSmart™ team leveraged the Support Vector Machine and Dominance Analysis capabilities, NLP and Sentiment Analysis of AroniSmartIntelligence™ and AroniSmartInvest™ and uncovered interesting insights.

The analysis includes two parts. This is the second part of the analysis, in which AroniSmart™ team analyzed the performance of internally selected stocks from Dec 2021 to December 22, 2023. The first part of the analysis focused on the NLP and Sentiment Analysis of the stock market in general (see here ).

Figure 2: Market Indices and AroniSmartInvest™ NLP Selected Stocks Sample to Watch

Figure 3: Market Indices

Figure 4: AroniSmartInvest™ NLP Selected Stocks Sample in Dynamic Sectors

Figure 5: AroniSmartInvest™ NLP Selected Stocks Sample in Key Industries

Figure 5: AroniSmartInvest™ NLP Selected Stocks Sample in Tech

The insights below, as the second part of the analysis of AroniSmart™ on the dynamics at the end of 2023 , are built on leveraging the Econometrics, Time Series, and Dominance Analysis capabilities of AroniSmartIntelligence™ and AroniSmartInvest™.

Dynamics and Trends at the end of December 2023.

The insights below by AroniSmart™ team are based on the data as of December 22, 2023 and captures the dynamics as Year 2023 ends.

The key findings highlight: Most of the stocks highlighted in early Q4 2023 analyses continue to drive the dynamics. These stocks continue to experience a significant increase after a decline in the last weeks of October 2023 (AroniSmartIntelligence™ and AroniSmartInvest™ Stock Market Sentiment and NLP Analysis: Market Sentiment and Highlighted Stocks in Mid November 2023).

Trend wise, most of the gains that happened in late July - early August 2023, were impacted in mid-August 2023 and September 2023 but seemed to come back in the first week of Q4 2023, before stepping back and then fueling the upward trend in November 2023 and December 2023.

The dynamics uncovered in the analysis are expected to impact the first weeks of Q1 2024.

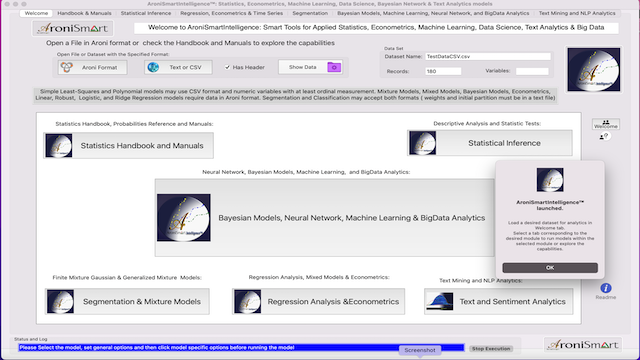

Figure 6: AroniSmartInvest™ Modules

Figure 7: AroniSmartIntelligence™ Modules

Figure 8: Market Segments

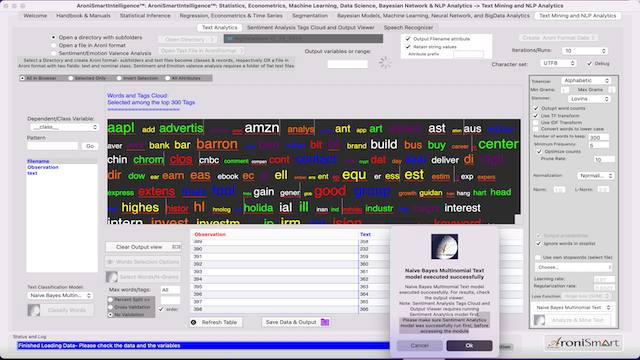

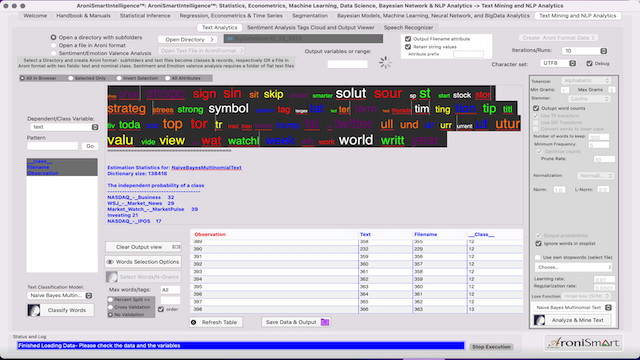

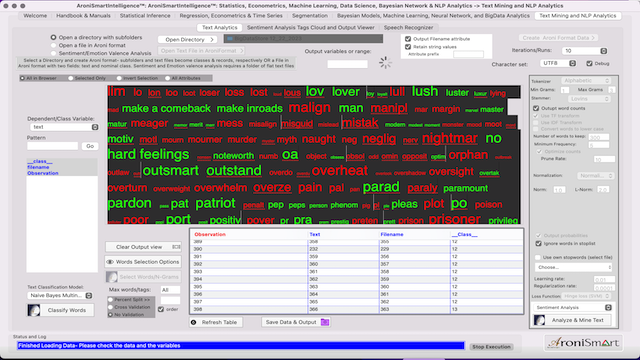

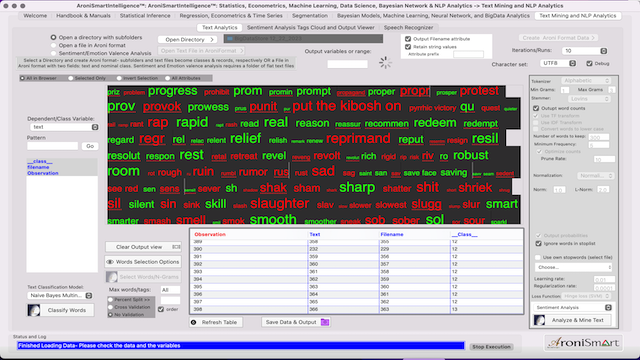

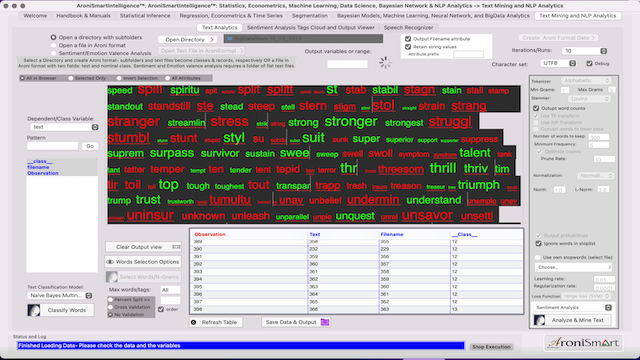

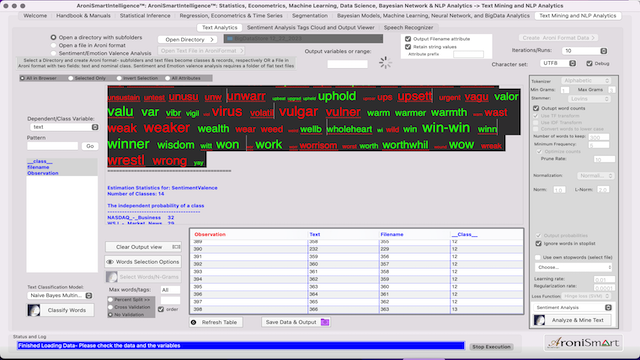

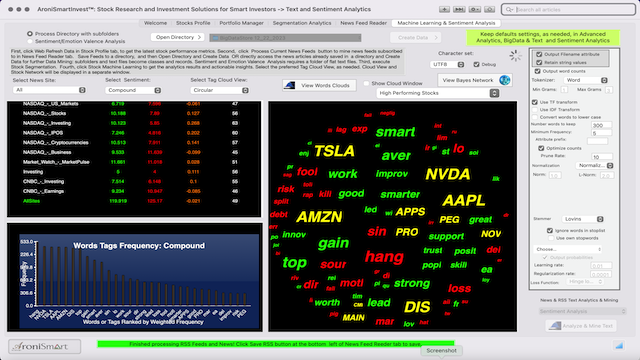

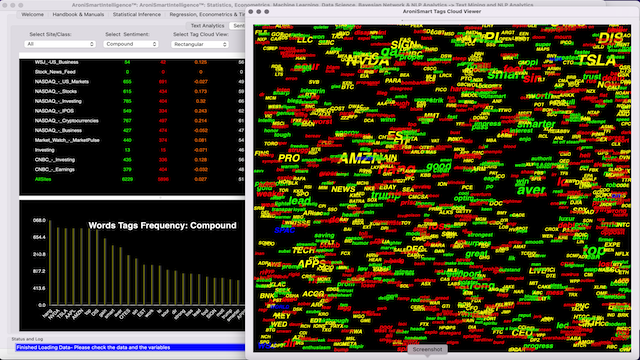

AroniSmart ™ NLP and Naive Bayes Analysis: Key Tags

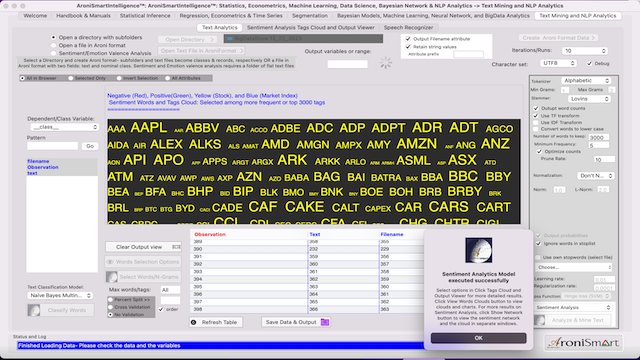

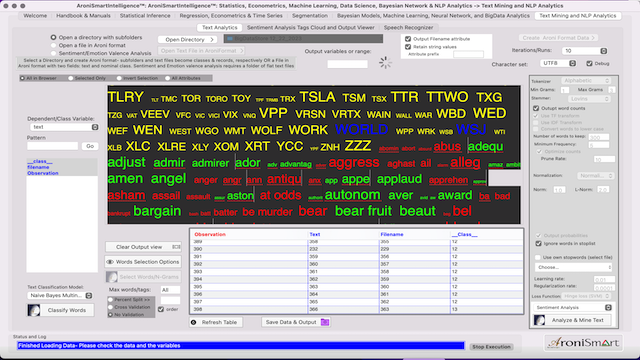

Figure 9-a: AroniSmart ™ NLP and Naive Bayes Analysis: Tags, Stocks to watch and Sentiment - A - I

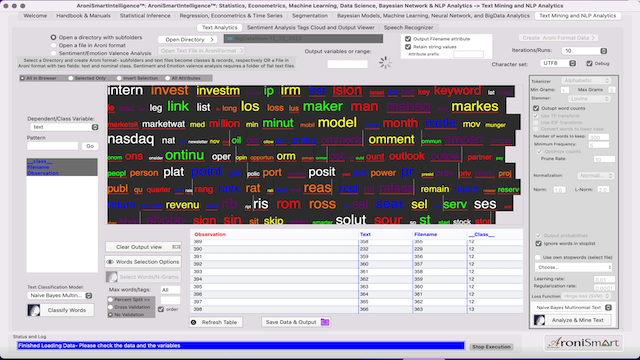

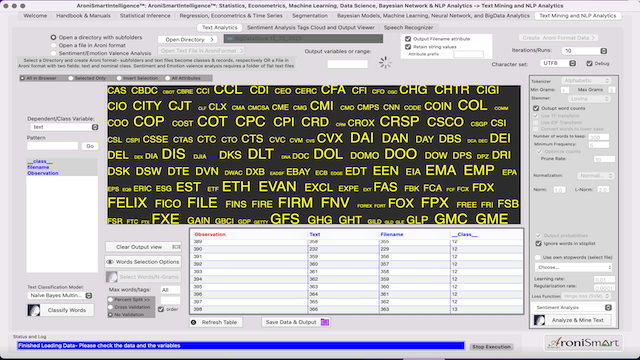

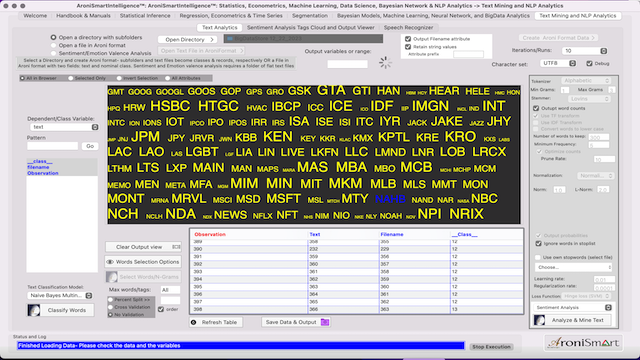

Figure 9-a: AroniSmart ™ NLP and Naive Bayes Analysis: Tags, Stocks to watch and Sentiment - I - S

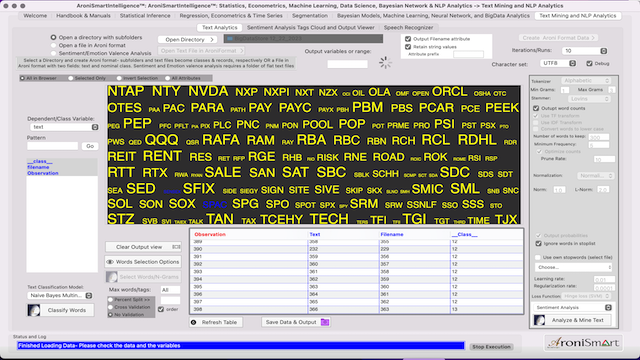

Figure 9-b: AroniSmart ™ NLP and Naive Bayes Analysis: Tags, Stocks to watch and Sentiment- S - Z

AroniSmart ™ Sentiment Analysis: Stock To Watch

Figure 10-a: AroniSmart ™ Sentiment Analysis: Stocks to watch A - C

Figure 10-b: AroniSmart ™ Sentiment Analysis: Stocks to watch C - G

Figure 10-c: AroniSmart ™ Sentiment Analysis: Stocks to watch G - N

Figure 10-d: AroniSmart ™ Sentiment Analysis: Stocks to watch N - T

Figure 10-e: AroniSmart ™ Sentiment Analysis: Stock to Watch T - Z

AroniSmart ™ Sentiment Analysis: Key Word Tags

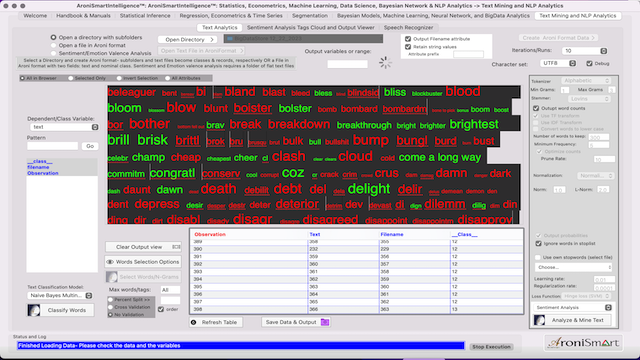

Figure 11-1: AroniSmart ™ Sentiment Analysis: Word Tags A - D

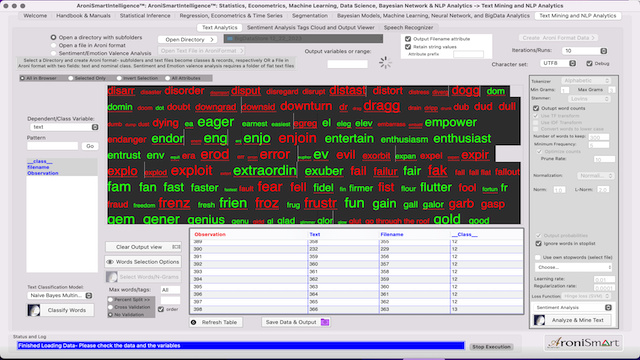

Figure 11-a: AroniSmart ™ Sentiment Analysis: Word Tags D - G

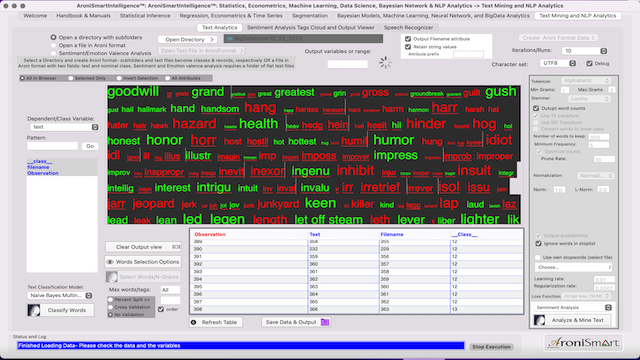

Figure 11-b: AroniSmart ™ Sentiment Analysis: Word Tags G - L

Figure 11-c: AroniSmart ™ Sentiment Analysis: Word Tags L - P

Figure 11-d: AroniSmart ™ Sentiment Analysis: Word Tags P - S

Figure 11-e: AroniSmart ™ Sentiment Analysis:: Word Tags S - U

Figure 11-f: AroniSmart ™ Sentiment Analysis: Word Tags U - Z

Advertisement

Get the following books on Amazon:

Legs of Tornado: The Human Who Outran the Wind, an African tale about a human from a humble upbringing who outran the wind, defeated evil spirits, overcame his fate, became a respected clan chief, and triumphed ever after.

Click Here to Get the books: Even Roosters Dream to Fly and Legs of Tornado

Even Roosters Dream to Fly along with Legs of Tornado are also available on Amazon worldwide and soon on several other platforms:

For more on the book, the author, the inspiration of the stories, Visit the author website here

Check the Book Video trailer of Even Roosters Dream to Fly, here

Sentiment Analysis: Stock Market Sentiment and Positivity Index, Key Positivity and Negativity Tags, Stocks to Watch

Figure 12 - c: AroniSmart™ NLP and Sentiment Analysis: Key Stocks to Watch and Tags

Figure 12- d : AroniSmart™ NLP and Sentiment Analysis Positivity and Heavy Word Tags

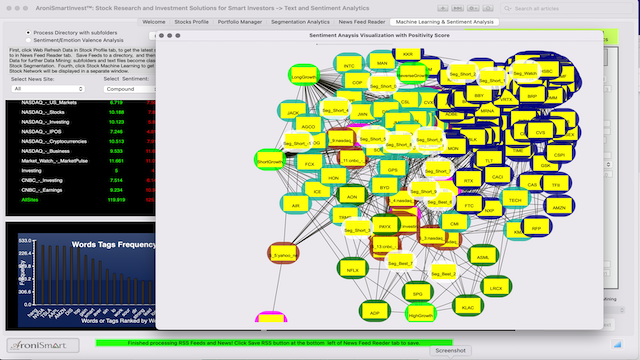

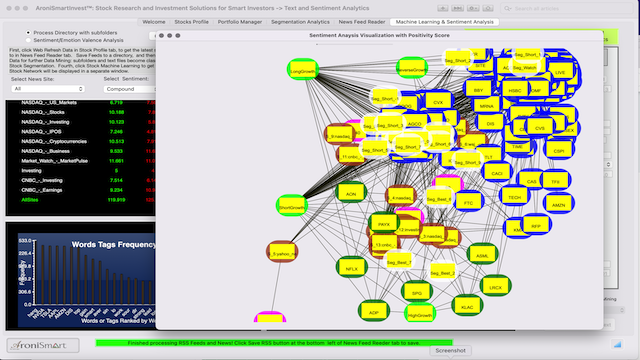

Bayesian Modeling and NLP analysis: Stocks to Watch and High, Short, Long Term, Reversal Growth Stocks

Figure 14: AroniSmart™ Stocks Bayesian Network View: Stocks to Watch and Long Growth

Figure 15: AroniSmart™ Stocks Bayesian Network View: Stocks to Watch with Short Growth, High Growth and Reversal Growth

Advertisement

GET ARONISMARTINTELLIGENCE™ on App Store

AroniSmartIntelligence™, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

Econometrics, Time Series and Dominance Analysis of the Stock Market Dynamics

AroniSmart™ team analyzed Dow Jones Industrial Average Index (DJI) performance dynamics, leveraging the Support Vector Machine and Dominance Analysis capabilities of AroniSmartIntelligence™ and uncovered interesting insights, as shown below. The team analyzed the performance of DJI vs 9 other internally selected stocks from Dec 11, 2021 to Dec 22, 2021.

From the analysis, it was found that most of the selected stocks basically follow similar trends, even though with uneven and differential momentums. Also, they are all impacted by the market conditions. However, the analysis found important nuances.

The key findings highlight with a positive view: most of the stocks studied had an upward momentum over the period. However, like the general stock market, they faced a slowdown and high volatility in late Q1-Q2 2023 before bouncing back in Q4 2023. Trendwise, since November 2023, the stocks have been on fueled momentum reaching high or record price levels. The upward momentum accelerated in December 2023 , for most stocks.

Over 2023 Dow Jones (DJI) built on an earlier momentum, remaining with most of the stocks under the AroniSmart study.

By December 22, 2023 most stocks were above the average Q1 2023 levels. In Q1 and Q3 2023, DJI momentum was significantly impacted by the market conditions. Since late November 2023, it bounced back and has maintained the momentum (see chart below)

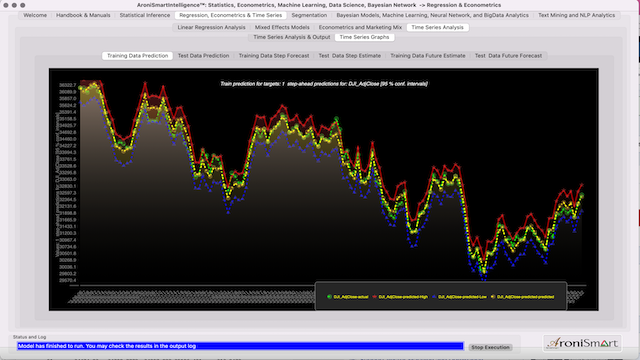

Figure 16 - a: DJI Trends and AroniSmart™ Projections Analysis Between May 2023 and December 2023 - Training Data Projectiion

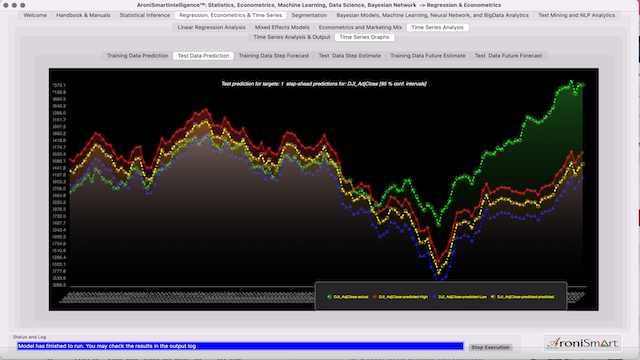

Figure 16 - b: DJI Trends and AroniSmart™ Projections Analysis Between June 2023 and December 2023 - Test Data Projection

AroniSmartIntelligence™ modelling shows the prices of the stocks that appear to mirror each other: a high opening for the stocks that tends to lead a decline or slow down in DJI's closing value and a high opening for the stocks that tends to lead an increase or growth in DJI's closing value. Late Q2 - early Q3 dynamics dynamics appear to positively impact DJI, whereas the end of Q1-early Q2 2021 appears to have been challenging.

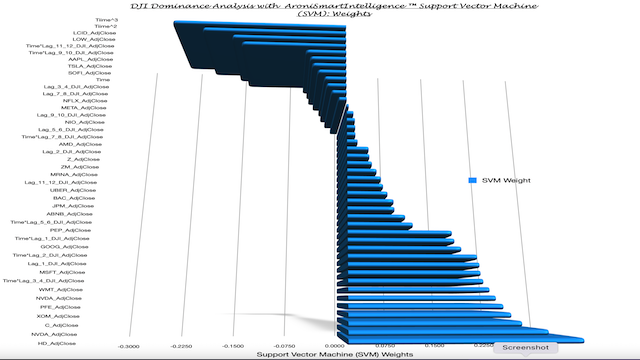

AroniSmart™ analysis, using Support Vector Machine modeling, shows below the weights of the different stocks, with LCID, LOW, AAPL, TSLA being on the negative side,HD, C, XOM, PFE, NVDA, WMT, GOOG, PEP, AIRBNB, BAC, UBER, MRNA, Z on positive side and LO and NFX, META, NIO, AMD on the neutral side.

Figure 17: DJI Dynamics - AroniSmart™ Support Vector Machine Analysis Results on the Period Between December 2021 and December 2023

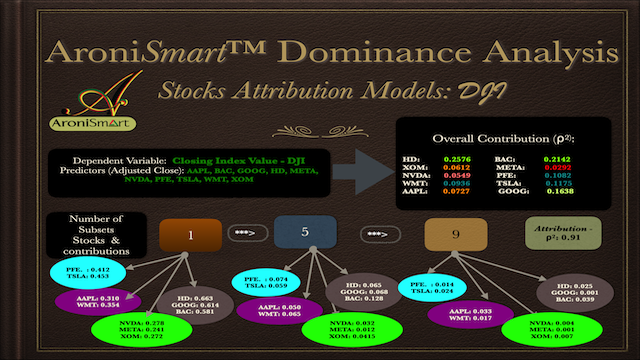

AroniSmartLytics™ Dominance Analysis confirms Support Vector Machine results: DJI momentum impacted in 2023 and not aligned with the momentum of most of other stocks.

AroniSmart™ team analyzed the DJI performance dynamics using Dominance Analysis capabilities of AroniSmartIntelligence™. The team uncovered insights confirming the performance dynamics of DJI vs a sample of 9 internally selected stocks from December 2021 to December 2023.

See below:

Figure 18: DJI Dynamics - AroniSmart™ Dominance Analysis Results on the Period Between December 2021 and December 2023

More detailed analyses can be conducted using AroniSmartIntelligence™ Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities.

For more on AroniSmartIntelligence™ and AroniSmartInvest™ capabilities, visit AroniSoft web site by clicking here. AroniSmartInvest™ and AroniSmartIntelligence ™ are available on Apple's App Store.

©2023 AroniSoft LLC.