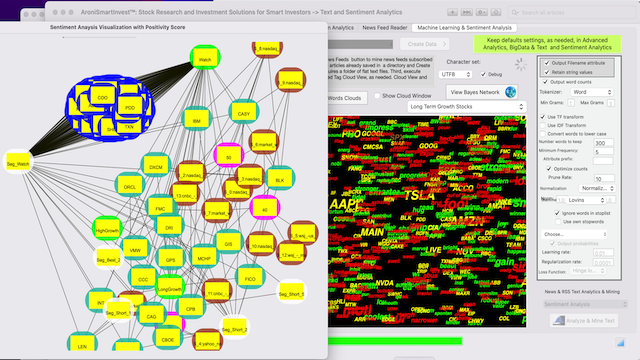

AroniSmartIntelligence™ and AroniSmartInvest™ Stock Market Sentiment and NLP Analysis: Market Sentiment and Highlighted Stocks in Mid Q1 2025

In Q1 2025, Stocks across industries have continued to experience, yet, a resilience. The trend was built on the dynamics of Q3 - Q4 2024. Hence, the market has continued to remain on the foundations of Q4 2024, which overtook the challenges in mid Q2 2024, when all the key market indices, including Crude Oil (CL=F) and 10-Yr Bond (^TNX), declined from the top reached in late July 2024. By mid Q1 2025, the gains observed in Q4 2024 have continued to hold. The current levels appear to continue to be driven by the diminishing challenges and world expectations following the US elections, which led to the stocks and indices pushing through Q4 2024 with a significant improvement in performance. Hence, since Q4 2024, the stock market adjusted to the previous dynamics that have been leading to increasing market volatility, including inflation, world events, and other challenges that started in late Q2 2022 and in October 2023 and showed up again in Q3 2024 . The US elections in 2024 appears to have a limited impact on the dynamics. Hence, the performance and factors in the end of year 2024 remain the main drivers of the persistence. On February 17, 2025, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™, looked at the stock markets news and trends.